Giving you an overview of your cash inflow. Open the website of your bank, go to advanced search and select income of the previous month. This should not be too difficult, as nearly everyone uses internet banking, allowing you to oversee your income and expenses of the previous month. Step 3, Chart your income of the previous month

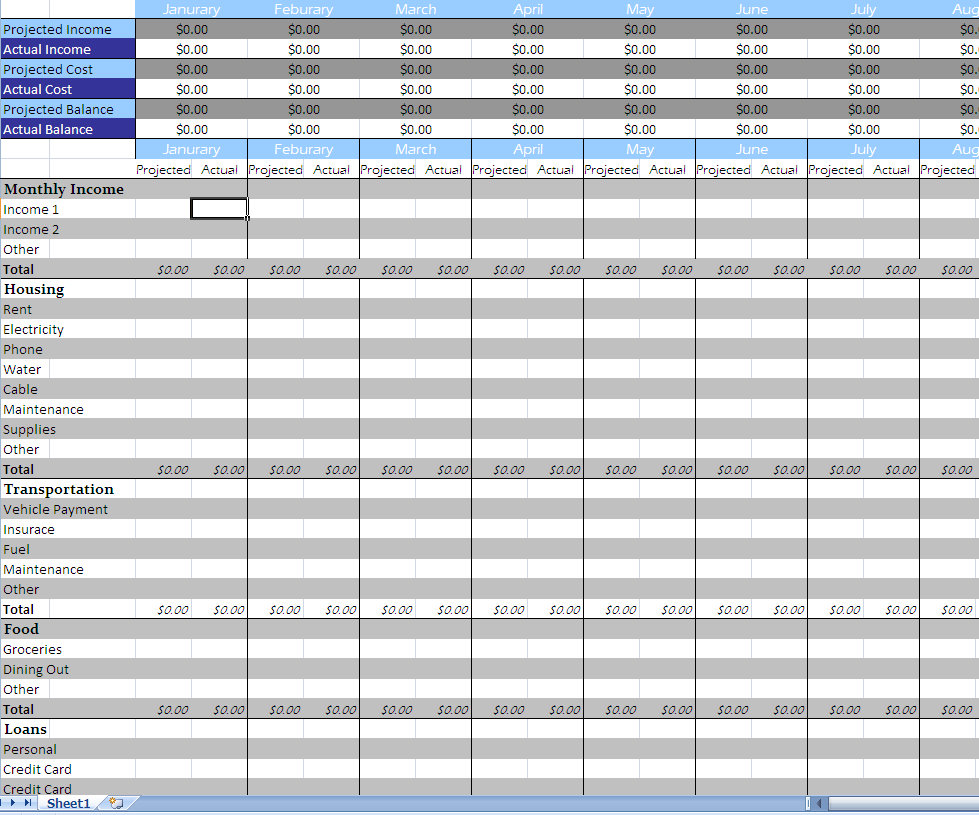

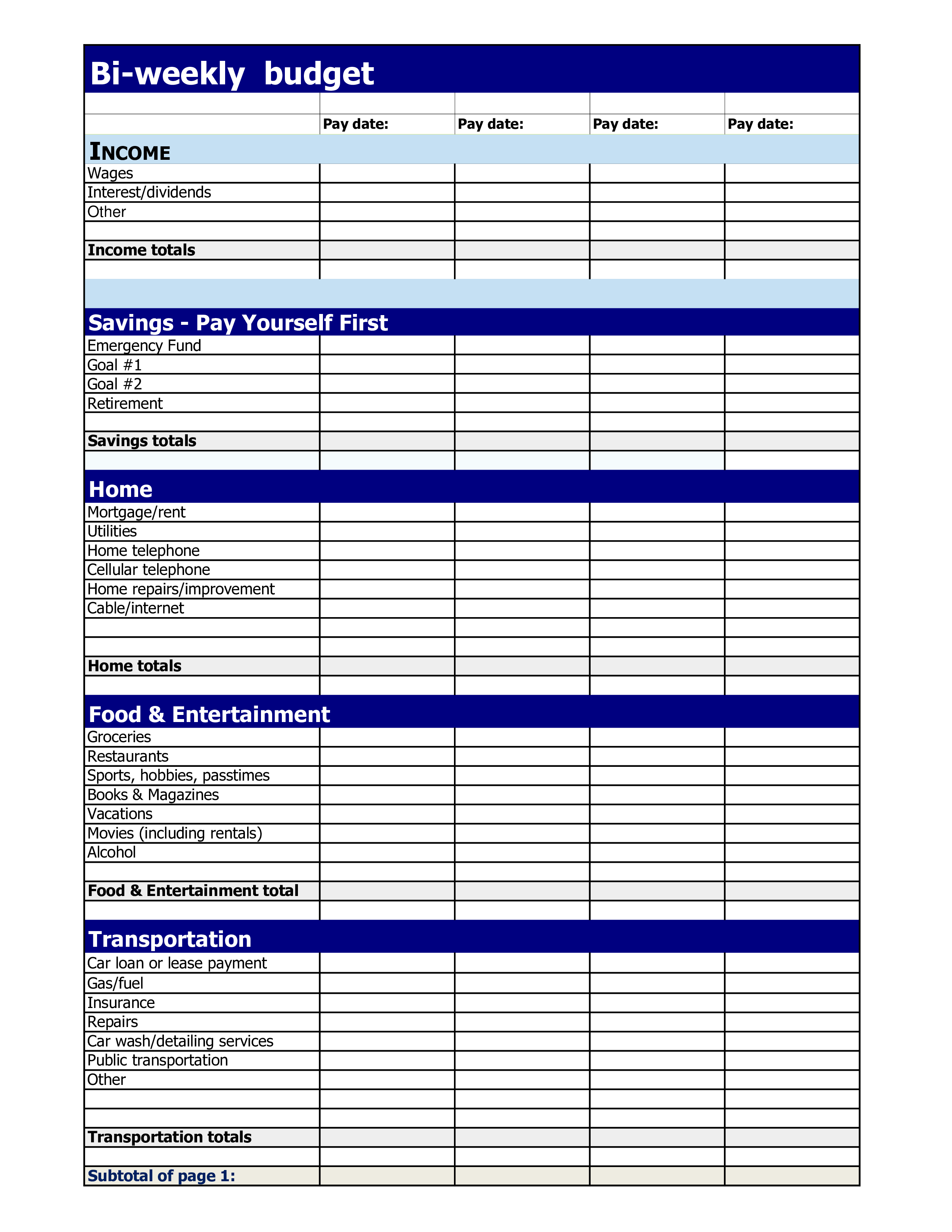

This is done through the tab of “Income and expenses” You only need to enter the month and the year. Log the date you before you start using the budget planner. Once you have filled in the budget planner, it should look like the following image: You will see at the top left corner in the menu bar “file”, when pressing this you are able to make a copy of the budget planner. Once you have access to a Google account and are able to use the web version of the planner. You do require a Google account for this, if you do not have an account then you must first sign up with Google. Do you not have Excel? Then use the button that states to contain the Google Spreadsheet, to look at the web version of the planner.If you are using Excel then use the button that contains the Excel planner.

MONTHLY EXPENSES TEMPLATE EXCEL HOW TO

How to use Excel Budget Planner? Check out the video! You can leave any questions, queries or suggestions in this group.

MONTHLY EXPENSES TEMPLATE EXCEL DOWNLOAD

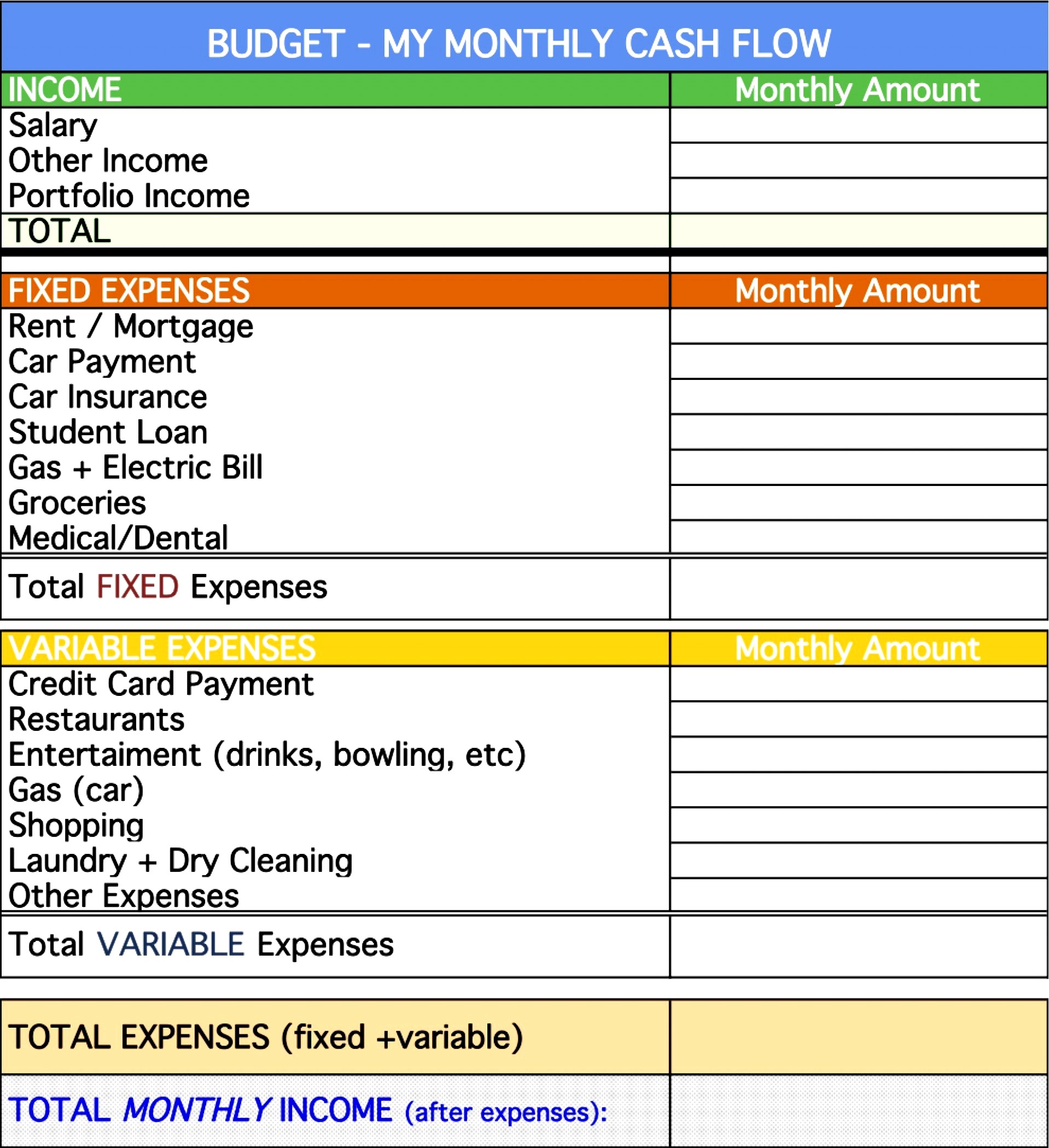

We created a budget planner in excel that is easy to download and log your expenses in.īelow is an explanation of the budget planner and how to use it, register for The Budget Club (Facebook group). This requires willpower but can be very rewarding. While doing so reflecting on your income and expenditures. It is important if you really want to change your expenditures, you follow a pattern of logging your daily and weekly costs. It starts by planning your income and expenses. Taking a thermos could save you a lot of money.Īchieving a budget surplus at the end of the month means you don’t have to borrow any money to tie you over until the end of the month. However, on a monthly bases this will accumulate to a total of £60. For instance, buying a cup of coffee or tea at the station every week day, may not seem expensive when it is only £3. Do you often feel that money disappears from your account? Leaving you wondering where and how you spent that money or would you like to save an extra £100 per month for something special? Often we spend our money on things that seem trivial, but when added up it amounts to a substantial monthly cost.

0 kommentar(er)

0 kommentar(er)